Technical analysis is based on the belief that important information about a stock is expressed by its price and volume history. It involves the use of patterns that emerge when a stock price is charted in order to study and interpret the supply and demand of the security…and this is then looked to in an effort to predict price movements. Essentially, technical analysis looks at the price chart of a security to try to determine where the price will go in the future. Of course, what happened in the past isn’t a guarantee of what will happen going forward, but understanding it can help you reach a more informed decision.

Why study charts? They’re valuable because they’re often easy-to-read visual representation of a security's price movement over a specific time period. They can make it easy to spot the effect of key events on a security's price, as well as its performance over a specific time period, and whether it's trading near its highs or near its lows—or in between.

With charts, you study such measures as price movements and trading volumes to determine certain patterns—including resistance and supply levels, head and shoulders formations, and moving averages. These indicators try to identify whether a stock is overbought or oversold, and try to identify patterns that might indicate whether a trend will continue or reverse.

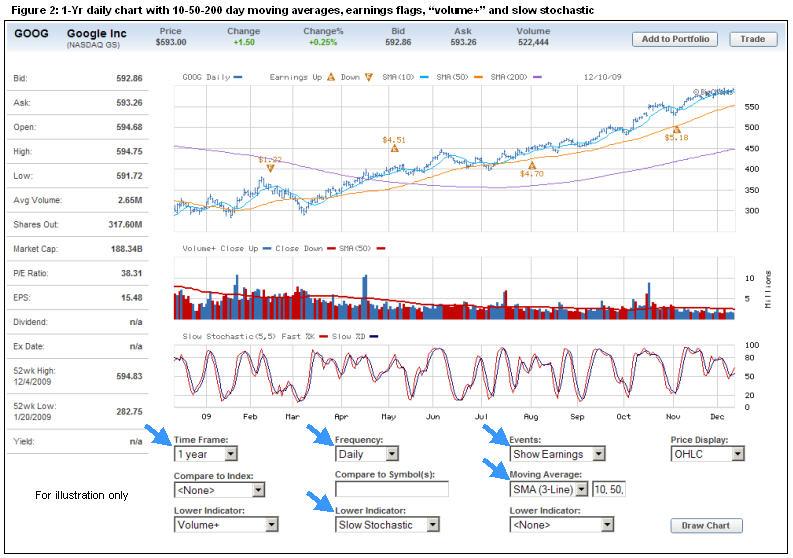

When you use a chart to find a candidate or follow a position, you start by picking a timeframe and a frequency, then add further indicators…volume by price, relative strength, etc. Depending on the capability of the charting tool at hand—the number of indicators available, for example—you can fine-tune a chart to tailor it to your approach and needs.

Read more:

Finding Short Candidates With Technical Analysis

Learn how to distinguish tops and bottoms in the equity market when short selling.